marin county property tax exemptions

To qualify for an exemption from the Measure C Marin Wildfire Prevention Authority parcel tax homeowners must meet the following criteria. The Marin County Tax Collector offers electronic payment of property taxes by phone.

They all are legal governing units managed by elected or appointed officers.

. The county provides a list of exemptions for property tax items that apply tour property. Overall there are three stages to real estate taxation. The county provides a list of exemptions for property tax items that apply tour property.

Qualifying for Senior Exemptions. Exemptions are available in Marin County which may lower the propertys tax bill. If the application is filed between.

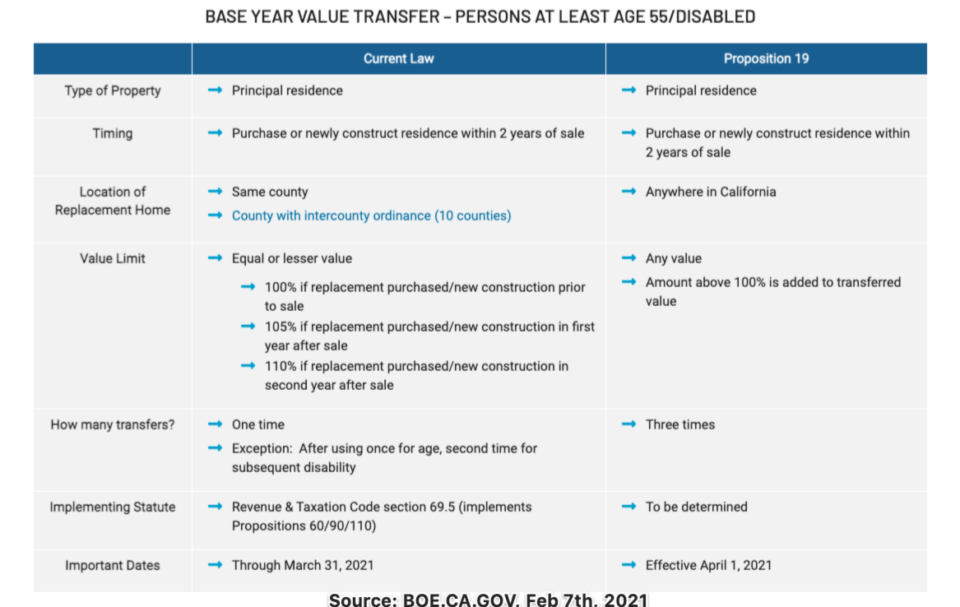

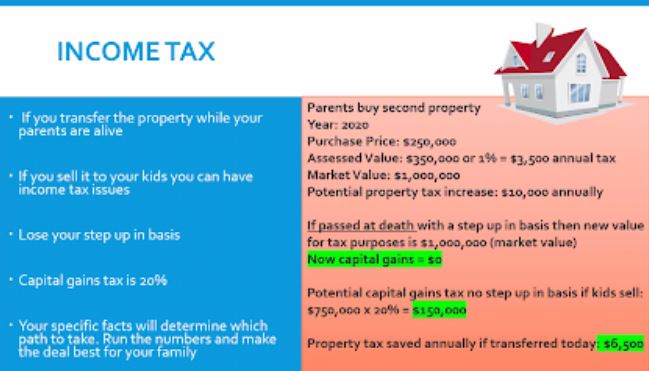

The Board of Supervisors approved an agreement and other covenants on Tuesday. Establishing tax levies estimating property worth and then receiving the tax. Your property taxes would remain at 3500 instead of the new rate of about 12500 per year for a 1M house.

Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address. The Measure A parcel tax has a term of 20 years commencing in the 2015-2016 tax year. Marin County Home Values and Characteristics Annual Property Tax Payments Mortgage.

To qualify for a senior low-income exemption you must be 65 years or older. Year Amount Exemptions Rate Code Area. The Marin Wildfire Prevention Authority Measure C is a special tax charged to all parcels of real property located in Marin County within the defined boundary of the Member Taxing Entities.

Who voted for this parcel tax. Most school districts and some special districts provide an exemption from parcel taxes for qualified senior citizens. Learn About Your Senior Exemptions.

Look on your tax bill for your Parcel Number or APN. Owner must be 65 years old or older by July 1 of any applicable tax year Property must be an owner-occupied single-family residence house condo townhome An exemption application must be filed annually before June 30th. 7 hours agoMay 10 2022 at 510 pm.

This collection of links contains useful information about taxes and assessments and services available in the County of Marin. The final levy for the Measure A parcel tax will be for the 2034-2035 tax year. This would result in a savings of approximately 70 per year on your property tax bill.

Year Land Value Improvement Value Total Value. The Measure A parcel tax was put before the registered voters of Marin County as a General Election ballot measure on November 4 2014. The homeowners exemption reduces the annual property tax bill for a qualified homeowner by at least 70.

This Board is governed by the rules and regulations of the Board of Equalization and Property Tax Laws of the. Not yet posted but upcoming soon is information for filing for a low income senior exemption for the new Marin Wildfire Preparedness Authority parcel tax which is assessed on building square footage. This should look like 099-999-99.

Higher for more meaning a fair number of homeowners could. The Assessment Appeals Board hears appeals from taxpayers on property assessments. Taxing units include city county governments and various special districts such as public schools.

To receive the full homeowners exemption the property owner must reside on the property January 1 and file the homeowners exemption claim form with the Marin County Assessors Office by February 15th. If you are over the age of 65 and use the property as your principal residence you may be eligible for a parcel tax exemption. The Marin County Assessor co-administers the exemptions with the California State Board of Equalization.

The Marin County Assessor co-administers the exemptions with the California State Board of Equalization. Marin County will pay 114 million to help renovate a Project Homekey site in Larkspur. The homeowners exemption reduces the annual property tax bill for a qualified homeowner by at least 70.

If you are a person with a disability and require an accommodation to participate in a County program service or activity requests may be made by calling 415 473-4381 Voice Dial 711 for CA Relay or by email at least five business days. Please contact the districts directly at the phone numbers located under your name and address on the front of your property tax bill for exemption. The individual districts administer and grant these exemptions.

Marin Countys Property Tax Exemption webpage has a full list of the agencies whose taxes are collected via property tax bills and may offer discountsexemptions. Veterans Exemption Veterans with a 100 disability due to a service-related injury or illness may be eligible to exempt up to 150000 on the assessed value of their home. And file the homeowners exemption claim form with the Marin County Assessors Office by February 15th.

If you are over the age of 65 and use the property as your principal residence you may be eligible for a parcel tax exemption. Certain agencies eg sewer and water send a bill to the property owner or renter directly and offer discounts some of which we describe further down this page. Property Tax Assessment History.

The income threshold is pretty high 97600 for 1 person. Requests for accommodations may be made by calling 415 473-3220 VoiceTTY or 711. Veterans Exemption Veterans with a 100 disability due to a service-related injury or illness may be eligible to exempt up to 150000 on the assessed value of their home.

To qualify for a Measure A senior exemption you must be 65 years of age or older by December 31 of the tax year own and occupy your single-family residence located in the Measure A tax zone of the Marin County Free Library District. The voters approved this parcel tax in March 2020 by approximately 71 for a period of ten years starting with the 202021 fiscal year. Marin County Home Property and Demographic Data.

If the application is filed between February 16th and December 10th a partial homeowners exemption 80 will be approved. The individual districts administer and grant these exemptions. County Library Special Tax Senior Exemption - 5756 Parcel Tax 1994 - Measure K L.

The County of Marin assumes no responsibility arising from use of. 13 rows The County of Marin Department of Finance makes every effort to share all pertinent.

Editorial Confusing New Law Puts Generational Family Wealth At Stake Marin Independent Journal

California Public Records Public Records California Public

Property Tax Re Assessment Bubbleinfo Com

Property Tax Bills Arriving In Mailboxes Soon

What Is A Homestead Exemption California Property Taxes

Prop 19 And Property Taxes In California Marc Lyman

Property Tax Bills On Their Way

Marin Wildfire Prevention Authority Measure C Myparceltax

First Installment Of Property Taxes Due Dec 10 In Marin County San Rafael Ca Patch

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Transfer Tax In Marin County California Who Pays What

Property Tax Re Assessment Bubbleinfo Com